Avoiding mistakes, in comprehensive financial planning, can make achieving the goals and dreams much more effective. Part 1 of this three-part series explored three of the 9 Comprehensive Financial Planning Mistakes. The three risks were: Thinking Taxes are the Exclusive answer, It is Not a Good Time to Invest, and Focusing on one Factor. The prescription for avoiding mistakes is to engage in the comprehensive financial planning process. Let’s move on the next three.

Ignoring Inflation:

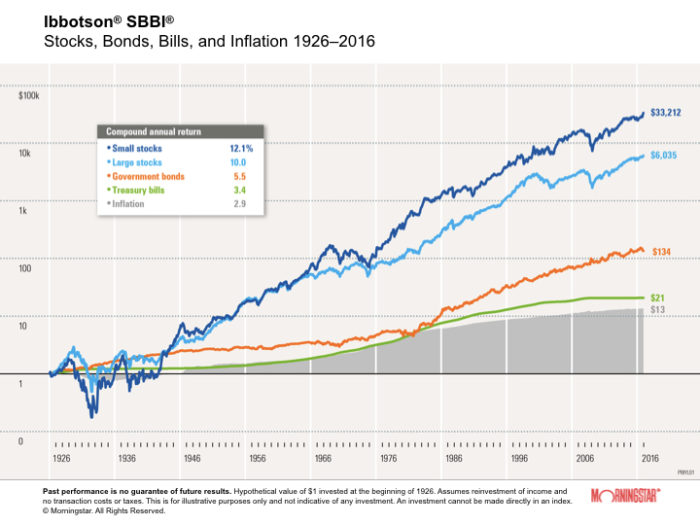

Virtually all investors have a common objective; save and invest capital now to spend later. If not, then why delay gratification for even one second. In that case, a comprehensive financial plan is totally unnecessary. A major cost to success in comprehensive financial planning is the purchasing power lost through inflation In my book, The Four Horsemen of the Investor’s Apocalypse” examples of the cost of inflation are identified. Note in the chart below that all the asset classes provide at least some hedge against inflation. Yet, fixed income investments, such as cash and bonds provided the least help.

Offsetting Inflation

While the appearance of safety in Bonds and Cash seem comforting during difficult times in the markets they do little to help investors have more inflation-adjusted capital to spend later because they were too risk adverse. Risk was indeed accepted. Capital erosion by inevitable rising costs of goods and services. That said they are effective tools as part of a diversification strategy. To increase the effectiveness of a comprehensive financial plan is to provide a high probability path to having the inflation-adjusted capital to spend lat

Not understanding risk:

The fear of losing capital ranks very high (and a number of related bias’) on the emotional catalysts to do exactly the wrong thing at exactly the wrong time hindering a comprehensive financial plan.

Over the 40 plus years, because I have had the opportunity to work with clients, I can tell with near certainty, the bottom of a stock market cycle. That is when the number of concerned calls increases and the collective fear of the marketplace is the greatest. The more and intense the calls, the likelihood of the market being at the bottom. In other words, the compulsion to sell at the bottom and buy only when things look like things are going in the right direction (for an extended time, of course) encourages the purchase at or near a high and selling at or near a low. That’s a head-slapper, isn’t it! The biggest risk to an investors success is their own emotional reactions to the markets. Seem like someone should do something about that, right?

Understanding the various facets of risk and the strategies that mitigate them is an important exercise. In a previous post, “Taming the Risk Monster” the different components of risk are identified and explained.

Not having a comprehensive financial planning process in place:

Clearly, our stock and trade is the development of comprehensive financial strategies to shine a light on the path to accomplishing a variety of financial goals and dreams. Things like having the financial independence to not have to rely on employment or having the ability to launch your children with the tools of an education that fits their dreams, or designing a philanthropic plan to accomplish a wide variety of societies needs. Former President and War General Dwight D. Eisenhower said In preparing for battle “I have always found that plans are useless, but planning is indispensable”.

My practical experience in 40 plus years in assisting clients validates Eisenhower was exactly “spot on”. Without the focus planning brings to the process little can get accomplished in reaching the goals and dreams everyone wants. With a properly thought out plan, the plan can adapt and change as circumstances warrant. Without a plan in place, every discussion starts at ground zero. In simple terms, people that engage in planning are much more likely to achieve their goals and dreams than those who don’t.

Summary:

With proper planning and execution of well thought out strategies, one can do the best job possible in avoiding mistakes. Yes, we are human beings, and we are subject to bias’ and temptation. That said, regular reviews and updates to the comprehensive financial planning process will bring an investor back to the high-probability path of accomplishing their financial goals and dreams.