When the good Lord was handing out patience I must have been in a hurry to get to the front of the line for something else because I’m terribly short of it. For some reason I get ‘way too much value’ out of rushing and getting to meetings on time or getting the new techno toy. Waiting has never been something that gave me a good feeling. I find it interesting that I am in a career where a long-term view and patience is a virtue. Might it be that my impatience elsewhere is compensation for the need to be executing and developing long-term strategies designed for long-term success?

Success in investing does require patience, and a significant measure of it to be successful, yet most human beings that will happily wait in line for a Starbucks coffee, are not able to exhibit enough discipline to allow a strategy to pay off. Why? I’m sure there are many reasons, but fair expectations and an appropriate frame of what time horizon is reasonable often are at the center of any frustration.

Time horizon is an interesting concept, especially for those approaching an age where they may consider removing themselves from the workforce and relying exclusively on their investment assets. The emotions it triggers are interesting from both a rational and occasionally irrational basis. Yes, the money and what it is doing become infinitely more important as the reality of the use becomes closer. The notion that they’ll be relying, pretty much, exclusively on financial resources to meet their day to day needs, and the paycheck is no longer coming, is something that suddenly seems all too real. This can bring waves of conservatism that bring feelings of needing to reallocate the portfolio to a much more conservative position.

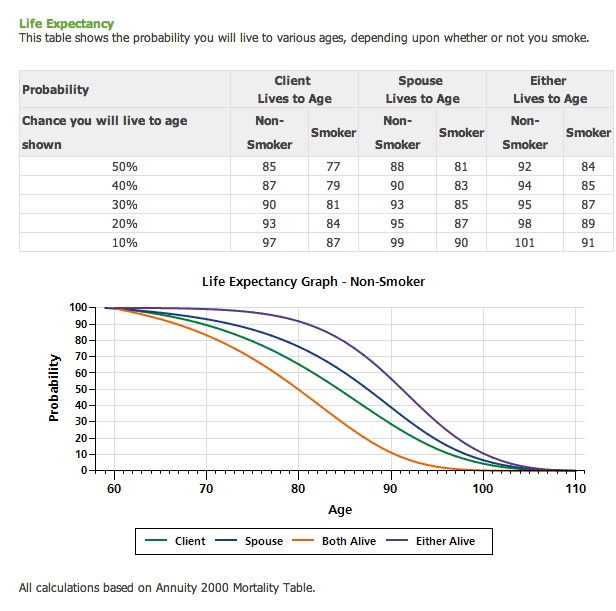

There is a difference between ‘growing’ a portfolio and ‘conserving’ a portfolio. Knowing one’s time horizon and how the resources will be deployed over time is critical. In too many cases the perception that a portfolio should be allocated in a certain way, based on age, all but guarantees a person/family will run out of money pre-maturely. How does this happen? Some are relying on ‘old wives tales’. For instance, a person should have their age minus 100 in stocks or equities with this being relevant 50-100 years ago when life expectancies were lower than today. Today, for a couple in their early 60”s (see table below) there is an even chance one of them will still be alive in their 90‘s. That means that the time horizon is much longer than it used to be due to improved health care and medical technology. Who knows where this will lead in terms of life expectancies. In the end the biggest risk for a portfolio is no longer volatility but, rather keeping up with inflation eating away at our purchasing power. That requires a different set of expectations and investment strategies than our parents and grandparents were comfortable with.

Portfolio design in a wealth management strategy has never been more important. A realistic view of the time horizon relevant to the goal has a significant and far reaching impact on the ability to live in a financially independent way.