“Risk comes from not knowing what you’re doing.” -Warren Buffett

Developing a highly effective comprehensive wealth management strategy involves the integration and coordination of multiple components including taxation, wealth transfer tools, and, of course, risk of various types to protect assets and meet objectives. The focus of this series, as part of a comprehensive wealth strategy, is on investment risk as one of the many risks that people face.

The formula for a magic potion to reduce investment risk is to combine multiple factors of risk into a outcome that reduces volatility and level of risk overall. Some may be surprised by the previous statement. Often investors think that by adding multiple factors of risk the strategy is more, not less, risky. This comes from a focus on the pieces, and not the combined impact of the entire portfolio.

Focusing on the pieces makes as much sense as evaluating a recipe for a cake and eliminating flour, since on its own, flour is not very tasty. It is the combination of ingredients that make a cake, and leaving on out has its consequences. In the last installment of Taming the Risk Monster, ten investing risks were identified. EVERY investment has an element of risk to it. Focusing on the flour instead of the cake is a common investor misjudgment when it comes to constructing an investment portfolio design. Various types of risk actually compliment each other, like the ingredients for a delicious cake. The key is knowing how each piece of a portfolio can come together to make the whole less risky and more effective.

In baking a cake, the taste test is the ultimate proof of the recipe being a good one. Clearly, tasting a portfolio is nonsensical, yet there are other tests to ascertain the effectiveness of a portfolio. The correlation statistic is a clear and accessible example.

A low correlation signifies that the assets being compared, while each having certain risks, tend NOT move in the same direction to certain events. By matching assets with a low or negative correlation to each other, overall volatility will be reduced, improving the effectiveness of a portfolio.

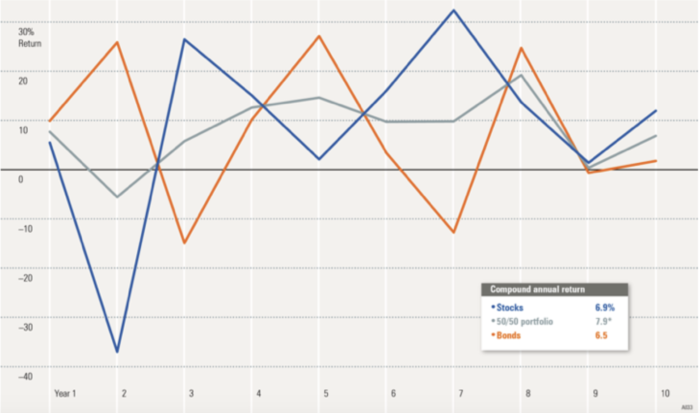

The chart below showing the relationship between stocks and bonds relative performance illustrates the impact of having two asset, each negatively correlated with each other.

The two asset classes (types of assets) generally move in distinct and separate paths, providing more stability and security for an investor. Yet, each asset class on its own presents distinct and separate risks that the investor should be aware of. In the case of bonds, the prevalent risks include rising interest rates, default, and inflation are primary, with a little reinvestment risk as well. In the case of stocks, the risk are primarily market risk and company industry risk.

While these two asset classes are widely known and part of an investors nomenclature, these two are not the only tools in the investor’s toolbox. In fact, there are many more. One of the resources I use in my investing classes is a study by BNY Mellon, that shows the asset class forecasts for a multitude of asset classes and published correlation statistics for each. Starting on page 14 of this publication, you can easily scan across and down to find how each asset class correlates with each other. The “greyed” cells are assets that are negatively correlated with one another. While negative correlation is nice, assets with low correlation, less than 70, should be considered as well.

With this information, an investor or financial advisor, can construct a spreadsheet and model various scenarios on how a portfolio can be expected to perform over time given certain assumptions.

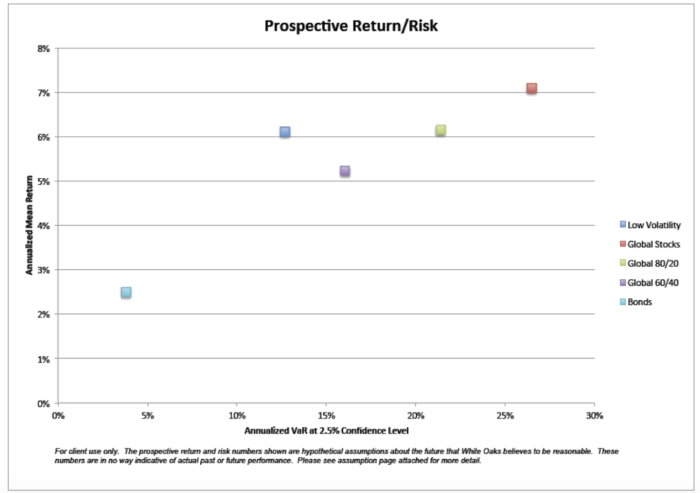

The chart below is a chart constructed to show the risk-return characteristics of various strategies.

The further to the right on the chart is the level of risk as measured by volatility. The higher on the chart is the higher the return. Many investors would prefer to be further left and higher up on the chart. By adding more asset classes, in an intelligent manner, risk can be muted and returns enhanced by accessing more of the tools in the investing toolbox.

Assumptions: