It is common for investors to react emotionally when it comes to investing, particularly when considering the various forms of alternative investments. For some, the concept of investing in non-traditional or alternative investments is new and, as a consequence, is a bit scary. Yet, as pointed out in my two previous posts, “Alternative Investments: How Less is More” and “Alternative Investments: 7 Principles for Selection” the use of these alternatives compared to traditional investing choices brings many benefits including lower volatility, and as shown, this lower volatility can help investors that use their portfolios to meet income and financial security needs and makes it a more effective investment solution.

A barrier for investors is focusing on one type of risk – liquidity risk, versus others. Commonly it is believed that there are 9 forms of investment risk. Adding alternative investments to a portfolio offers an investor the opportunity to mitigate many of these risks and it is not uncommon to find some with illiquidity associated with it. Some would hasten to point out that there are a number of alternative investment mutual funds that operate using some form of non-traditional investing. Isn’t that a solution to the liquidity question? After all, aren’t they investing in the same thing?

For some alternative investment strategies, the answer is yes, with a caveat. For example, some strategies such as managed futures, or long-short equity are very liquid and ETF’s and mutual funds can a be a good solution. The caveat? Imagine yourself as a manager who on any day has no idea if money will be coming into his fund or leaving. Can the alternative investment manager then make any type of longer-term decision? Will the manager be forced to sell/unwind a strategy because investors have requested their money? In a world where many people lament the notion that no one thinks long-term anymore, the investing world is expecting great things. Inefficiencies in the market happen and it may take only a brief time of a few days, yet the manager’s hands are tied when operating in a daily liquidity world.

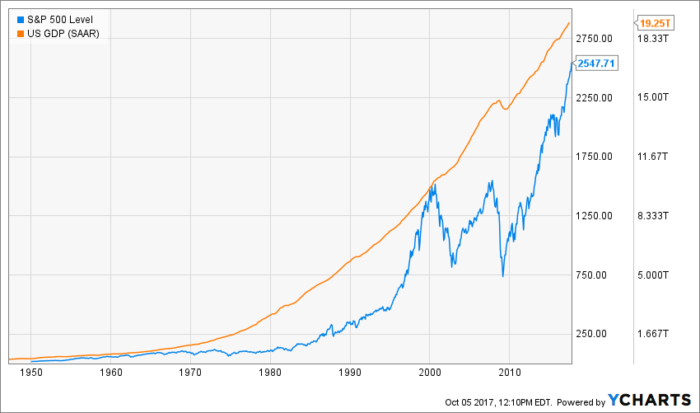

Is liquidity bad? Of course, not!! The bills must be and will be paid! Yet, as was shown in “Alternative Investments: How Less is more”, volatility is an enemy to be reckoned with. Let’s start by considering the stock market. We all know the stock market goes up and down and we all look to the economy to give us clues for what will happen to our stock investments, as shown in the graph below, however, the volatility of the economy is much lower than the volatility of the stock market!

So??? Why is the stock market volatility is driven by investors emotion, specifically, fear and greed? When the market is going down we are compelled to sell because we want to preserve our hard-fought and earned investment capital and won’t invest again until it “feels better’. Of course, the market has already had significant gains otherwise we would not feel better. In the end, this is the reason that investments outperform investors.

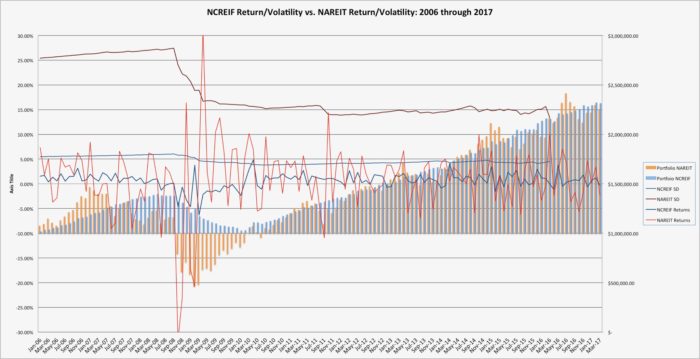

So what about other types of investments, let’s say real estate? After all, you can buy shares of a Real Estate Investment Trust (REIT) as an alternative investment. The chart below shows the difference in volatility of the daily liquid REIT in the National Association of Real Estate Investment Trusts (NAREIT_ index versus National COuncil of Real Estate Investment (NCREIF). The lines show the ups and downs of the returns. As it is shown, the red line, showing the liquid NAREIT Index goes up and down much more as compared to the blue line representing the NCREIF portfolios.

Notice also in the bars, denoting the cumulative value, they both end up in the same place over time. Of course, this makes sense since they are both investing in the same types of investments. The difference? The impact of emotional, short-term investment decisions by investors. The NCREIF portfolio is not daily liquid so the emotional impact on the investment portfolio is sidestepped.

This liquidity paradox is also demonstrated in other asset classes including private equity. Many investors would endorse the notion that long-term thinking is the best for investment portfolios. The more we as investors focus on liquidity the more we subscribe to the emotional impact other investors decisions make on our portfolio. Liquidity is critical in meeting long-term investment goals. To have an entire portfolio illiquid would be silly and this article is not promoting that notion. Yet, if the focus is entirely on liquidity the long-term financial strategy is also exposed to risks that can be mitigated. Ample cash reserves go a long way in optimizing a sound strategy and combined with a well-balanced portfolio, financial security can be enhanced.