In a recent post I surfaced the notion that investors “more than occasionally” make decisions during periods of market volatility that do not serve their best interests. Buying “best performers” when they have been hot and selling them when they have cooled off. Morningstar, a premier rating service for financial instruments, recently decided to add dollar weighted returns to their analysis. Dollar weighted returns are the returns the investors in the fund actually achieved. This shows the impact of the timing of their purchase rather than the overall long-term performance of the fund manager. Unfortunately, investors tend to buy after they seen the investment go up in value and sell when they become fearful. This happens of course when the markets have already declined.

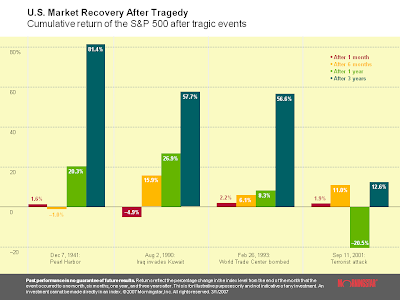

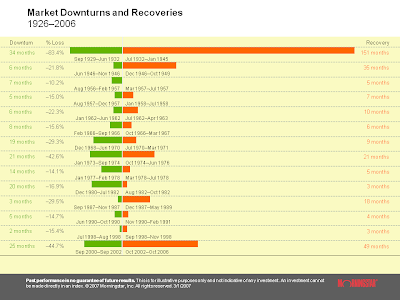

After a decline, the market usually changes direction abruptly and the bounce is usually quick and quite significant as the chart below indicates that the time to a full recovery is short in duration.

This is true even if the event is considered to be a major shock to the economy. The above chart shows four major events with far reaching impacts on the economy and the resulting re-bound in value. A common response is that it’s “different this time”. While the event is different the human reaction to the event is very common and familiar.

The words investing discipline are often seen together. By following an “investing discipline” an investor can remove the emotions from their investing outcomes and reach a more successful outcome. On our website under White Papers is an important article entitled The True Meaning Of Risk by Sharon Bloodworth, VP of White Oaks Wealth Advisors, Inc. on other aspects of the Risk/Results decision.