Advice abounds about how much to have in your emergency fund (our answer: 6 months of living expenses if you’re working, 18-24 months if you’re retired), but the logistics of how and where are less discussed. Here are four things to keep in mind when making decisions about your emergency fund:

Keep your emergency fund in cash.

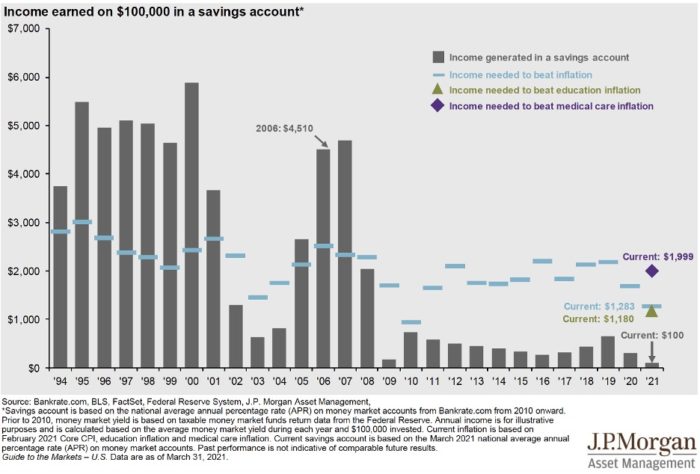

Cash is always king, but especially when it comes to urgent situations. It can be hard to keep your emergency fund in cash when, historically, cash yields have not kept up with market returns or even inflation. The chart below shows that cash yields have been higher than inflation in only eleven of the past twenty-eight years, and they haven’t beat inflation since 2007!

That said, it is still important to keep your emergency fund in cash. Personal finances are about optimizing your investment portfolio, but they are also about managing your risk. Having a robust emergency fund is one of the key ways you can manage your risk in that it ensures you have ample cushion when something bad happens, like a market crash. Needing to replace your furnace, for example, and having to use investment funds to do so in a time when the market is down can have a significant impact on your overall financial plan.

Additionally, while it can be tempting to use a line of credit as an emergency fund, many banks close or reduce lines of credit in turbulent times. Those turbulent times are exactly when you’re most likely to need your emergency fund, so it is best to keep it in cash.

Keep your emergency fund in its own account.

This will help you refrain from spending it outside of true emergencies.

Keep your emergency fund in a high-yield account.

It’s true that cash has not historically returned as much as investments in the market, but you can still invest your cash in an account that earns the highest interest available without exposing your cash to the risk of a market downturn. Bankrate.com publishes a great summary each month of the bank accounts with the highest interest rates.

Stay under the FDIC limit at any one bank.

The FDIC insures up to $250,000 per depositor per ownership-category per FDIC-insured bank. This means that if an FDIC-insured bank were to fail, the FDIC would cover the depositors dollar-for-dollar up to at least $250,000. If your accounts at any one bank have a collective balance higher than $250,000, you’ll want to keep an eye on your FDIC coverage. For reference, the FDIC has a great tool to check your coverage here. If you are over the limit, a simple solution is to open a new account at another bank and transfer some cash over until you are under the FDIC insurance limit at each bank.

Please contact the White Oaks Team for help or further questions regarding your emergency fund.